By GRSM MedicareTeam on October 30, 2019

Several changes regarding administration details have been made in Version 3.0. The biggest changes include new Consent Form language for WCMSA submissions requiring the Beneficiary acknowledge his or her understanding of administration, references to Medicare Part D coverage guidelines for Frequently Abused Drugs, and a link for professional administrators to upload account transactions and view account details. Also, among these significant changes are the extension of Amended Review timeframes and hospital fee clarifications.

It must be the end of October, as the Medicare Secondary Payer industry is seeing new program changes, with plenty more in sight. Today the Centers for Medicare and Medicaid Services disseminated the updated Workers’ Compensation Medicare Set-Aside (WCMSA) Reference Guide version 3.0, dated October 10, 2019. The 3.0 Reference Guide is geared toward greater emphasis on Medicare Set-Aside administration, from several different fronts. Proper administration of CMS-approved Medicare Set-Asides ensures the preservation of post-account exhaustion Medicare entitlements. So is this emphasis on administration a warning signal of Medicare benefit jeopardization and/or increased vigilance in monitoring accounts on Medicare’s part?

CONSENT FORMS

In Section 10.2, Consent to Release Note, Version 3.0 adds the following language:

“As of April 1, 2020, all consent-to-release notes must include language indicating that the beneficiary reviewed the submission package and understands the WCMSA intent, submission process, and associated administration. This section of the consent form must include at least the beneficiary’s initials to indicate their validation.”

It has been independently confirmed by CMS that current Consent Forms do not require this content prior to April 1, 2020. Figure 10-2: Example Consent to Release with Instructions, illustrates the location of the initial line and provides the necessary language to pass muster with CMS. Such language brings to mind the Medicare Learning Network literature of the last several years, which directed medical providers, suppliers and facilities to direct bill Beneficiaries with Medicare Set-Aside accounts, so that Medicare would not be billed when a case reached settlement, judgment, award or other payment. Including this new language in the Consent Form documents the Beneficiary’s awareness of, and agreement with, a Medicare Set-Aside and its content, as well as the intent, process and administration of an MSA, all prior to submission. While Beneficiaries and their attorneys have always had access to the contents of a submitted Medicare Set-Aside and supporting documentation, this adds a new layer of accountability for the Beneficiary in the Medicare Set-Aside process.

FREQUENTLY ABUSED DRUGS

Version 3.0 includes a new provision in Section 17.1 Administrators, which explains account administration. New language states, “CMS highly recommends professional administration where a claimant is taking controlled substances that CMS determines are ‘frequently abused drugs’ according to CMS’ Part D Drug Utilization Review (DUR) policy. That policy and supporting information are available on the web at:

https://cms.gov/Medicare/Prescription-Drug-Coverage/PrescriptionDrugCovContra/RxUtilization.html

Further, Section 17.3 Use of the Account, also includes new language reinforcing the latter provision: “CMS expects that WCMSA funds be competently administered in accordance with all Medicare coverage guidelines, including but not limited to CMS’ Part D Drug Utilization Review (DUR) policy. As a result, all WCMSA administration programs should institute Drug Management Programs (DMPs) (as described at: https://www.gpo.gov/fdsys/pkg/FR-2018-04-16/pdf/2018-07179.pdf) for claimants at risk for abuse or misuse of ‘frequently abused drugs’.”

This aspect of the Reference Guide reflects Medicare’s new prescription drug policy that had started January 1, 2019 in which Part D plan sponsors could adopt drug management programs concerning beneficiary use of frequently abused drugs in an effort to combat opioid overuse as per the Comprehensive Addiction and Recovery Act (CARA).

ADMINISTRATION LINKS

In Version 2.9, Beneficiaries could review all documents submitted to CMS via http://www.mymedicare.gov. A physical address for also existed for beneficiaries or their representatives to mail exhaustion documentation. Version 3.0 maintains this option in item 17.7, but adds to Section 17.6 Electronic Attestation, options for electronic submissions of annual and final attestations, usable for either self-administered or professionally administered accounts respectively:

For more information about how to submit an attestation electronically, please see the WCMSAP User Guide, at https://www.cob.cms.hhs.gov/WCMSA/assets/wcmsa/userManual/WCMSAUserManual.pdf.

For more information on Professional Administrator accounts, please see the WCMSAP User Guide, at https://www.cob.cms.hhs.gov/WCMSA/assets/wcmsa/userManual/WCMSAUserManual.pdf.

The new links come on the heels of other CMS efforts concerning MSA account administration. On October 17, 2019, disseminated CMS updated its Self-Administration Toolkit for WCMSAs to Version 1.3, dated October 10, 2019, the same date as Version 3.0 of the WCMSA Reference Guide. The Toolkit Version 1.3 can be found here: https://www.cms.gov/Medicare/Coordination-of-Benefits-and-Recovery/Workers-Compensation-Medicare-Set-Aside-Arrangements/Downloads/Self-Administration-Toolkit-for-WCMSAs-Version-1_3.pdf

Additionally, Medicare disseminated information about two new webinars focused on WCMSA Electronic Attestation Enhancements. The first was to be held today for Medicare Beneficiaries and their representatives. https://www.cms.gov/Medicare/Coordination-of-Benefits-and-Recovery/Workers-Compensation-Medicare-Set-Aside-Arrangements/Downloads/WCMSA-Electronic-Attestation-Enhancement-Webinar-October-30-2019.pdf

The second is to be held November 6, 2019 and is for professional administrators. https://www.cms.gov/Medicare/Coordination-of-Benefits-and-Recovery/Workers-Compensation-Medicare-Set-Aside-Arrangements/Downloads/WCMSA-Electronic-Attestation-Enhancement-for-Professional-Administrators-Webinar-November-6-2019.pdf

AMENDED REVIEW TIMEFRAME EXTENDED

In its own new Section 16.2 Amended Review, Medicare pushes the timeframe in which an Amended Review will be considered from 12-48 months from the date of the original approval letter to 12-72 months from the original approval. This is a welcome expansion to the workload threshold as many cases more than four years past the original approval date have still not settled. Additional language in Section 16.2 fleshes out details surrounding some of the parameters for Amended Review. With regard to a change in treatment, the new version states that changes in treatment plans won’t be considered without supporting medical documentation. Also, Version 3.0 offers a link for details on electronic submission:

See the WCMSAP User Guide at: https://www.cob.cms.hhs.gov/WCMSA/assets/wcmsa/userManual/WCMSAUserManual. Pdf

HOSPITAL FEE SCHEDULES

The new Reference Guide offers much-needed specificity to the sources of hospital pricing for surgical procedures. In the previous version, Reference Guide 2.9 stated within Section 9.4.3 WCRC Review Considerations, “Currently the WCRC prices WCMSAs according to the correct region for the state of venue. Hospital fee schedules are currently determined using the Diagnosis-Related Groups (DRG) payment for a Major Medical Center within the state, and this fee is applied to all locations within the state.” Changes to this Section in the 3.0 version are that the hospital fee schedules are determined using DRG payments for the “median” Major Medical Center within the “appropriate fee jurisdiction for the ZIP code, unless otherwise identified by state law.” (Emphasis added).

ADDITIONAL CHANGES:

• Section 2.2 Reporting a WC Case now includes an address change to:

Medicare – Medicare Secondary Payer

Medicare Secondary Payer Claims Investigation Project

P.O. Box 138897

Oklahoma City, OK 73113-8897

• Section 17.5 Annual Attestation and Record-Keeping has clarified the following address for submitting yearly attestation material:

NGHP

P.O. Box 138832

Oklahoma City, OK 73113

• Section 10.3 Rated Age Information and Life Expectancy has been updated to reflect the most recent life table link:

“CMS will project the cost of the claimant’s future treatment over the claimant’s life expectancy, using the Centers for Disease Control (CDC) Tables. https://www.cdc.gov/nchs/data/nvsr/nvsr68/nvsr68_04-508.pdf

NOT IN THE REFERENCE GUIDE, BUT ON THE HORIZON

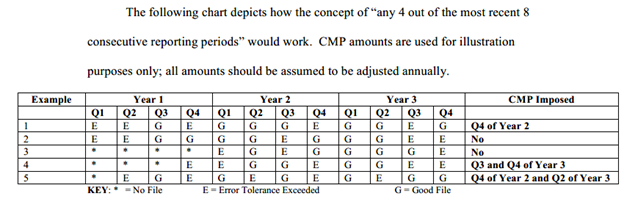

• Rulemakings! Civil Monetary Penalties for Section 111 Medicare Mandatory Insurer Reporting have not yet been issued. According to the OIRA office, rulemaking should be issued in October of 2019. Similarly situated is possible rulemaking for Liability and No-Fault Medicare Set-Asides, also slated for this month. Both of these items have been collecting dust for years and were scheduled for action in September, which gave way to October. Will what little remaining of October bring the proposed regulations? Or will these rulemakings be pushed into November or beyond?

• Speaking of November, we are only a few weeks away from the annual announcement of the low dollar recovery threshold. Will this amount increase for 2020?

Future updates regarding Medicare Secondary Payer laws will be monitored by the Gordon & Rees Medicare Compliance Team. Please stay tuned for more information as it becomes available!