CMS Publishes Final Rule on Section 111 Civil Monetary Penalties

By Melanie Schafer on October 11, 2023

On October 11, 2023, the Federal Register published the long-awaited Final Rule regarding Section 111 Civil Monetary Penalties. This rule has an effective date of December 11, 2023, and an applicability date on or after October 11, 2024.

The Rule’s salient points can be summarized as follows, with key differences between the requirements for group health plans (GHP) and non-group health plans (NGHP).

Method of Penalty Assessment: CMS will audit a possible 1000 records per calendar year across all RRE submissions (250 beneficiary records per quarter) and will evaluate a proportionate number of GHP and NGHP records. At the end of each calendar quarter, CMS will randomly select the indicated number of records and analyze each to determine if it is in compliance with reporting requirements.

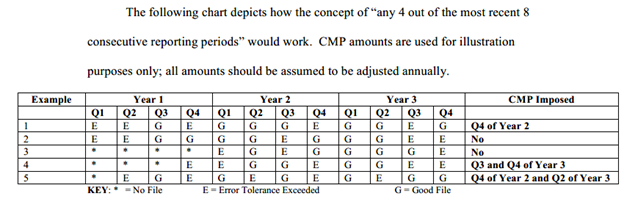

Grounds for Penalty: The final rule removes any basis other than timeliness from the penalties considered in the proposed rule. All references to “contradictory reporting” and “exceeding error tolerance” have been removed; timeliness is the sole basis for CMP per the Final Rule.

What is timeliness? Timely is defined as reporting to CMS within one year of

- the date GHP coverage became effective;

- the date a settlement, judgment, award, or other payment determination was made (or the funding of a settlement, judgment, award, or other payment, if delayed); OR

- the date when an entity’s ORM (ongoing responsibility for medicals) became effective

Penalties for GHP: For any selected record that is more than 1 year (365) calendar days late, a penalty of $1,000 per day as adjusted of noncompliance will be imposed

Penalties for NGHP: For any audited record where the NGHP RRE submitted the information more than one year after the date of settlement, judgment/award, or other payment (including the effective date of the assumption of ORM), the penalty will be:

- $250 as adjusted annually under 45 CFR part 102 for each calendar day of noncompliance where the record was reported on year or more but less than two years after the required reporting date

- $500 for each calendar day of noncompliance where the record was reported two years or more but less than three years after the required reporting date

- $1,000 for each calendar day of noncompliance where the record was reported three years or more after the required reporting date

Penalty Calculation Method: CMS will multiply the number of audited records found to be noncompliant by the number of days that each record was late (in excess of 365 days). That product will be multiplied by the appropriate penalty amount.

Penalty Cap: Total penalty for any one instance of noncompliance for a given record will be no greater than $365

Inflation: Penalties may be adjusted for inflation.

Penalty exceptions for GHP: Penalties will not be assessed for GHP in the following instances

- Where noncompliance is associated with a specific reporting policy or procedural change on the part of CMS that has been in effect for less than 6 months following the implementation of the policy change (or for a year, should CMS be unable to provide a minimum of 6 months’ notice prior to implementing change)

- The entity complies with any reporting thresholds or other reporting exclusions

Penalty exceptions for NGHP: The GHP exceptions are applicable for NGHP with the following addition

- Where an NGHP fails to report required information as a result of the plan’s inability to obtain the individual’s first or last name, date of birth, gender, Medicare beneficiary number (MBI), SSN, or last five digits of the SSN and the plan has made good faith effort to obtain this info as follows:

- The plan has communicated the need for the info to the individual and his or her attorney or other representative, if applicable, or both

- The plan has requested the info from the individual and his/her attorney/other representative at least 3 times (once in writing, including email; at least once more by mail; at least once more by phone or other means)

- The plan has not received a response or has received a response clearly indicating the individual refuses to provide the needed info

- The plan has documented its efforts to obtain the info. This documentation, including written rejection correspondence, must be retained for a minimum of 5 years

Relief: CMPs imposed in accordance with the final rule are subject to a formal appeals process. Parties subject to CMPs will receive formal written notice at the time the penalty is proposed and may request a hearing with an ALJ within sixty (60) calendar days of receipt. An ALJ decision may be appealed to the Departmental Appeals Board (DAB) within 30 days, with DAB decision binding sixty (60) days thereafter absent petition for judicial review.

Given the audit structure, the rule specifies that smaller entities are much less likely to have their records audited. The rule also confirms that it imposes no new information collection requirements—e.g. reporting, record-keeping or third-party disclosure requirements. We anticipate that CMS will host webinars and town halls in the future to discuss the new rule and will keep abreast of same.

Disclaimer: Please note, this article is intended to be a high-level summary of the proposed regulation and is not intended to be an exhaustive review of every detail and requirement contained within the text of the proposed regulation. We will be providing updates as the program unrolls from CMS.

Given the timeframes of the rule, RREs have time to ensure that their reporting is compliant. Let us know if you want to schedule a meeting to discuss how your program can ensure compliance with the formal rule.

Please feel free to reach out to one of our team members:

Travis Smith – twsmith@grsm.com

Kimberly Young – kyoung@grsm.com

Melanie Schafer – mschafer@grsm.com

Rachel Maldonado – rmaldonado@grsm.com

Heather Eversole – heversole@grsm.com